How do you design a commission scheme that helps you compete for recruitment talent without eating into your bottom line? Let’s find out.

Once you identify how your rewards programme fits in with your business strategy and finances and how it motivates your team, it’s a good idea to gauge it against your industry peers. In this article, that develops on the ideas we share in The Recruitment Commission Handbook, we’ll look at how to do it. We’ll also look at some industry trends you may want to follow (or not) as you design your new commission scheme.

Why benchmark against your competitors?

But first, let’s look at why it’s necessary to compare your commission scheme to the ones your competitors offer.

We’re currently in a war for talent and good recruiters are highly sought-after. It’s likely your best consultants are regularly approached about new opportunities. If your commission programme pays your consultants lower than they can get elsewhere, you risk them jumping ship. On the other hand, if your rewards scheme is more generous than your competitors, you may be able to retain your best performers, but you needlessly eat into your bottom line.

The only way to be confident that you’re not paying too much or too little is to do some comparative analysis.

Comparative analysis

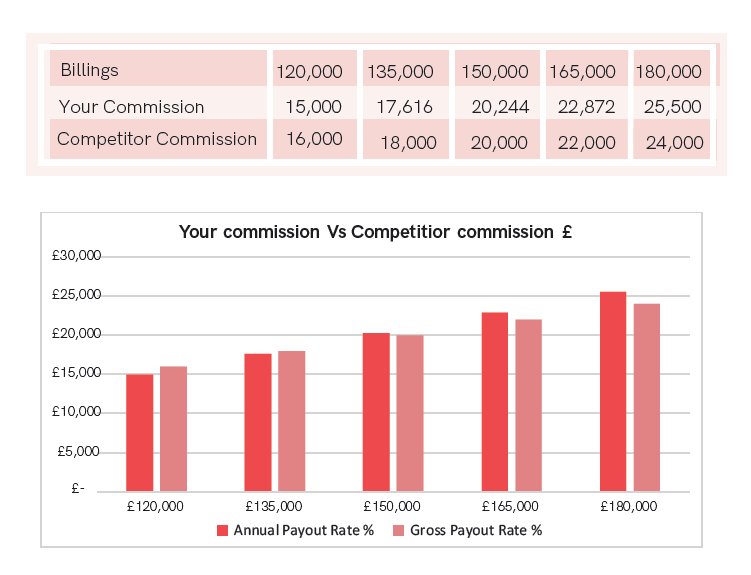

If possible, you should include some analysis of your commission scheme against your competitors. At a minimum, try to get a like-for-like comparison of payout rates at target performance and at least one degree above and below (10-20%).

It should look like this:

It’s difficult to know exactly how other agencies reward their consultants. However, Konquest can help you find out the information you need.

Industry trends

There are many ways you can set up a recruitment reward scheme. Let’s look at two policies you may want to implement in yours – one currently in vogue, the other falling out of favour.

1 – Pay when paid

During the pandemic, many recruitment companies shifted to a ‘pay when paid’ (PWP) policy to protect their cashflow. PWP means you shift the timing of your commission payments, only paying your consultant’s commission on a deal when the client’s payment is in the bank.

Before COVID, around 25% of recruitment agencies had a PWP policy for their rewards, but during COVID, this number went up to about 50%. Even though the pandemic is over and most of us are enjoying the best market in living memory, most agencies that brought in PWP have retained it.

While PWP effectively protects your cash flow, it can demotivate your consultants as it stretches the time between their action and their reward. Some consider it an unnecessary hurdle in the way of optimised motivation.

2 – Thresholds

Another trend in the industry is that fewer and fewer consultancies are deploying traditional thresholds in their reward schemes. A few years ago, thresholds were standard in the industry, with around 50% of agencies using them. However, today, this number is closer to 30%.

There are several reasons why this has happened:

-

Salespeople don’t like them – Recruiters will always choose to work at an agency that doesn’t have thresholds over one that does. A threshold can seriously hold you back in the post-pandemic war for talent, which is why many agencies have scrapped them

-

Market dynamics – In high-growth sectors (such as tech), average deal sizes are significantly larger than a consultant’s desk cost, so there’s little need for thresholds

-

Better management systems – Today’s recruiters run their teams differently. They are more confident that they can ensure high performance with a robust Performance Improvement Policy rather than run a threshold

Find out more from Konquest

The more you know about how your competitors operate their rewards programmes, the more likely you are to design a scheme for your agency that motivates, inspires and retains your people without damaging your bottom line.