How to Transition to a New Commission Structure Without Losing Your Recruiters

Getting your commission right as a recruiter is essential. Join us in this blog to learn how to make changes without upsetting your team.

The commission scheme at your recruitment agency is the fuel that powers your engine. It’s what keeps your consultants motivated to keep picking up the phone after the last five prospects have hung up on them. When you get your commission scheme right, it plays a massive part in your success. But getting it wrong can spell disaster.

In this article, we’ll look at our four pillars of commission schemes. You’ll have choices to make around each of them as you design your new scheme. But follow our guide and you’ll make the right selection. Let’s get started.

The structure is the most crucial element of any commission scheme. There are four aspects of structure that you must consider. Let’s look at each of them.

How will you measure a consultant’s performance to calculate their commission?

The three most common ways to do this are:

Transactional – A flat rate of commission per placement

Cumulative – A percentage of the consultant’s total billings. For example, if a consultant places two candidates with a value of £10K each, they’ll get a percentage of £20K

Contribution – In company structures where more than one team member is involved in a placement, you split the commission pot between them. For example, you divide the commission amount 70:30 between the consultant and the delivery consultant based on how much they contribute to the transaction

Next, you must decide how often your commission scheme should run. The aim is to give your consultants enough time to stack their deals.

Your choices are:

Monthly – best for high frequency, high volume businesses

Quarterly or Annual – best for low-volume businesses where a consultant may only make a handful of placements per year

If you choose a monthly structure, watch out for peaks and troughs from one month to the next. Consultants tend to stack their deals in good months to earn more commission.

We always say consistency is best, so if you must have a monthly commission scheme, consider adding a quarterly additional ‘kicker’. It will ensure you’re incentivising the correct behaviour.

Flat-rate schemes pay a consistent rate of reward regardless of performance. For example, a consultant receives 20% of their total billings whether they did one placement or twenty during the period.

The issues with flat rate schemes are:

They fix your payout rate, so you’re exposed to the risk of paying your highest rate of commission to underperformers

The rate of reward doesn’t correlate with the perceived increase in effort required to overperform. There’s not as much incentive to move from ‘good’ to ‘great’

On the other hand, flat rate schemes are appropriate when you want to incentivise a secondary output as a strategic priority. For example, if you’re a contract-heavy consultancy, you might wish to reward perm placements with a low flat rate scheme while maintaining a higher, progressive reward rate for contract placements, which are your main strategic focus.

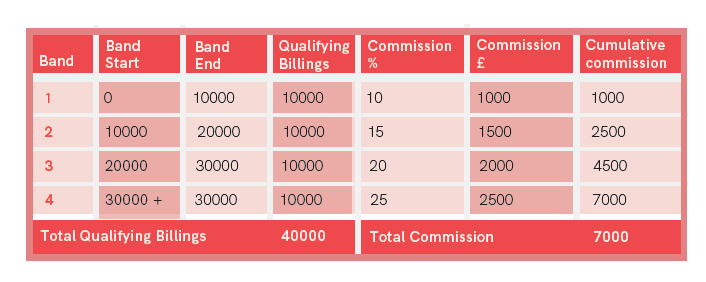

Alternatively, tiered schemes incentivise overperformance. In a tiered scheme, you have ascending ‘bands’ where the percentage of commission a consultant receives rises the more they bill.

In this example, as the consultant bills more, they climb the bands and earn greater rewards. At the start of the period, the consultant earns 10% commission on the first £10K billed, but if they can perform well and climb the bands, by the time they’re in Band 3, they’re earning 20% of everything between £20K and £30K. If they hit Band 4, they’ll get 25% commission on anything above £30K. It’s also known as the income tax model.

Tiered schemes are effective because they add an element of gamification, which is known to impact motivation significantly. There’s always the incentive to ‘do one more’.

Issues only arise when the bands are laid down without enough thought. Best practice is to align bands with deal size. So, if your average deal size is £10K, make your bands £0-10K, £10K-£20K and so on.

Thresholds are the way the industry manages risk related to variable compensation. It’s when – in their commission scheme – an agency applies a minimum level of performance a consultant has to hit before they qualify for commission. If they don’t reach their threshold, they don’t receive commission.

Thresholds are controversial because while they help agencies mitigate risk, salespeople do not like them. Often, consultants will cite thresholds as the reason they leave an agency to join one that doesn’t operate them.

You have a scale of options for thresholds. You can choose not to have them at all, but your risk is high. On the other hand, you can have an uncapped rolling threshold where you have no risk. In the middle, there’s a balance between agency risk and motivating your consultants.

Let’s look at these in order:

No threshold – You pay commission on all performance during the period, no matter how small

Inclusive threshold – Once a consultant hits the threshold, they are paid commission on everything they’ve billed so far

Exclusive threshold – The consultant qualifies for commission once they hit their threshold, but they’re only paid commission on billings over the threshold’s value

Cumulative threshold – A year-to-date threshold.

If I have a £120k annual cumulative threshold, the threshold accumulates at a rate of £10k per month.

E.g. in Month 1, I need to bill at least £10k to receive commission. In Month 3, I must have billed at least £30k cumulatively to receive commission. If I bill £60k in Month 1 and £60k in Month 2, I’ve exceeded my annual threshold for the entire year and I receive commission on all billings after that

Rolling threshold (capped) - Threshold compounds each period until it reaches a cap

e.g. for a £5k rolling monthly threshold, capped at £15k, the unmet balance will compound each month up to a maximum of £15k

Month 1 - threshold = £5k, if no billings

Month 2 – threshold = £10k, if no billings

Month 3 – threshold = £15k, if no billings

Month 4 – threshold = £15k, and so on

Rolling threshold (uncapped) – Like the above, but with no cap. If the above example was uncapped, Month 4 would have a £20K threshold, Month 5 £25K and so on

Some agencies choose the compromise option of having no overall threshold, but an additional ‘kicker’ layer of reward that does have a threshold.

However, unless you have a really good reason for implementing a threshold in your commission scheme (cashflow threatened by lengthy payment terms, bad debt), we believe that most of the time, the benefits don’t outweigh the drawbacks.

How quickly you pay commission is vitally important to the success of your scheme. ‘Immediacy of reward’ is known to affect motivation. The speedier the reward, the higher the motivation, the better the performance.

We see the ideal payment timing as one month in arrears of the start of invoice date for perm placements, or one month in arrears of the timesheet date for contract. Some factors may cause you to extend your payment timing, such as how your business is funded, payment terms and average debtor days. However, if your payment terms are strong and your clients tend to be good payers, one month in arrears gives you the best balance between cashflow management and the immediacy of reward.

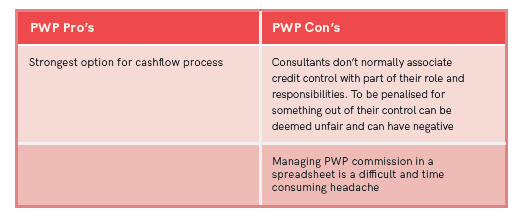

In an earlier article, we discussed Pay When Paid (or PWP). Many agencies operated a PWP policy during the pandemic when we were all concerned about cashflow. But some have not rescinded it even though we’re back to normal. If you’re operating PWP, be very careful, as there are advantages and disadvantages.

Finally, after you’ve decided on a structure, whether or not to have thresholds and your payment time, you need to think about how the numbers are going to work.

There’s no magic bullet for payout rates, but here are four bitesize tips we can share:

Focus on what you believe the right OTE (on target earnings) should be for each role

Start with what a consultant might expect to take home in the current market

Alternatively, work backwards from your target profit and profit margin to calculate the upper limit for salaries and commission

If you can, look at what your competitors pay their consultants

Once you have an idea of where you want to be, it’s time to create a spreadsheet and run the numbers. Your goal is to discover the numbers that work for you on both a net (commission only) and gross (commission, salaries and employers NI) basis.

Create your bands (if you’re having bands) and start with round numbers, calculating what someone in each role would get if they hit target performance. Adjust as necessary.

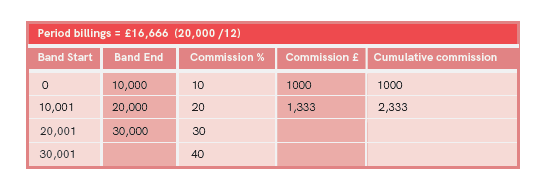

Let’s say that you’re modelling a scheme for a senior consultant with a £30k salary, an annual target of £200k and an OTE of £60k, and you’ve decided on a monthly commission scheme. The initial draft might look like this:

Total commission = £2,333/month, £27,996/year

Net payout rate = £27,996 / 200,000 = 13.99%

Total earnings = £27,996 + £30,000 = £57,996

Total payout rate = (£57,996 * 1.1505)/200,000 = 33.36%

You can see that you’re getting close to where you need to be, but keep adjusting until you’re spot on. Repeat this for each role in your business and ideally across multiple performance levels above and below target. This helps you achieve the right balance of reward for under and overperformers.

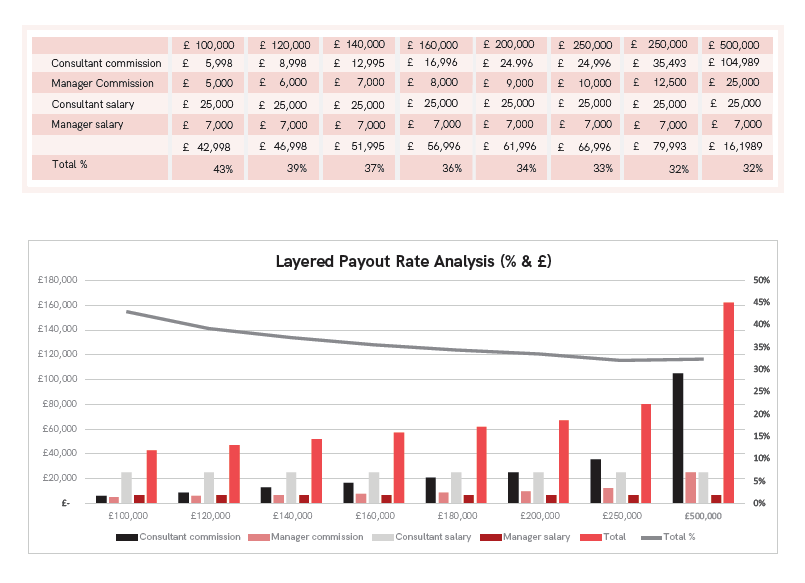

If you have additional layers of commission, such as accelerators or manager overrides, you’ll need to do some layered payout rate analysis to understand your real gross payout rate.

It’s a lot to think about, but with careful consideration, you can design a commission scheme that works for you and your consultants, motivating them to keep picking up that phone.

Getting your commission right as a recruiter is essential. Join us in this blog to learn how to make changes without upsetting your team.

See how 250+ recruiters structure commission in 2025. Get insights on tiers, thresholds, payouts, and what the top firms do differently.

While commission will surely be the bedrock element of your new rewards scheme, it doesn’t have to be the only method.

Be the first to know about new research, guidance and industry highlights by joining our newsletter subscription.